Ehmke shares thoughts on markets during Kansas Commodity Classic

Tanner Ehmke, lead economist for grains and oilseeds at CoBank, covered a lot of ground for attendees at Kansas Commodity Classic, Jan. 30, in Salina.

His customers from around the country are facing challenges with grain markets, geopolitical uncertainty and other concerns.

At the top of his list is tariffs.

“That’s a constant uncertainty when we have a quote, unquote trade deal,” Ehmke said. “Is it really a deal? Is it over with? Of course, not.”

Within the last year there’s been what Ehmke called a “trade truce” with the Europe Union. That changed because of Greenland. Then the tariffs were back on. Another truce was with China, but he has questions. The United States-Mexico-Canada Agreement is up for renegotiation or renewal in July, and that could play a part too.

“What leverage do you think the White House is going to use in those negotiations? It’s going to be probably tariffs,” he said. “Now the big question is, what happens with the Supreme Court, and are they going to rule against the IEEPA tariffs that Trump has been using as his leverage with all these countries?”

Even if the Supreme Court does rule against President Donald Trump on the International Emergency Economic Powers Act, there’s more tariffs he can use that go back over the past century to use at his discretion.

“Irrespective of what the Supreme Court does, we’re probably not going to be out of the woods when it comes to tariffs, which is to say we’re going to have trade uncertainty for at least the next three years,” Ehmke said.

Consequences of tariffs

Trade realignment is something to be aware of, too. Other countries working with the EU, China, Canada, and South America can change relationships outside of the U.S.

“Does that have any impact on our markets in the longer term, perhaps,” he said. “Not necessarily in the short term.”

Demographic changes are starting to slow the global economy because countries like China are now facing a shrinking population. Also, birth rates are falling, and family sizes are declining globally, and modern medicine allows people to live longer, he said.

That all impacts the U.S. economy and consumption. That ties directly into what Ehmke calls “slowbalization” because the global economy is slowing, too.

Ehmke said the dollar has continued to fall out of bed and is the lowest it’s been in four years.

“Uncertainty in general is quite high,” he said. “Is uncertainty good for business? Is uncertainty good for markets? Unless you have a gambling addiction, probably not. Uncertainty slows down the economy because it raises uncertainty on supply chains.”

Uncertainty on supply chains causes businesses to pull back, and according to Ehmke, uncertainty has hurt their customers.

“This is why it all comes down to trade,” he said. “And obviously in agriculture, we are heavily dependent on exports. We need exports. We still also need imports. We import a lot of seed, fertilizer and chemical.”

He believes U.S. farmers have paid about a billion dollars in tariffs.

“Half of that is on imported machinery parts. About a quarter of that has been on fertilizer, and the other quarters split between crop protectants or chemicals and seed,” he said. “All inputs have come up and have risen in cost because of tariffs that comes out of our margins.”

Global slowdown

Ehmke looks at the shipping industry and leading indicators note the slowness.

That means there is a slowing demand for commodities, too. But what about the dollar? A weaker dollar tends to help agriculture because it boosts exports.

“So, what’s going on? How much more do we have to go on the dollar? Well, that’s a tricky question we have to answer,” Ehmke said. “We have to ask the question, why is the dollar continuing to get weak?”

The Consumer Price Index measurement also helps judge the value of the dollar. Inflation has come down quite a bit, but higher interest rates, slower consumption, and higher prices have caused problems. So is the rising unemployment rate. The government is between a rock and a hard place, according to Ehmke.

“Do they raise interest rates to slow down inflation, or do they cut interest rates, not an easy position to be in,” he said.

Ehmke said President Trump wants low interest rates to pay for debt plus have a cheaper dollar.

However, even if rates were cut to zero, it doesn’t fix the problem because there is too many dollars chasing too few assets, Ehmke said.

Impact on grain markets

What does that mean for the grain markets? Ehmke said markets are not on an island, and we all live by the same rules.

“Every market follows this similar pattern. Prices are fun to ride up. They’re not so when they come back down,” he said.

When commodity prices spike and then come back down, the level of production changes.

“The average prices are a bit higher, because what happens? What do we do when we have higher grain prices?” he said. “We buy inputs, buy more land, machinery and fertilizer that pushes prices up and now you’ve got a new cost of production. It’s higher. Prices cannot fall below cost of production perpetually.”

Prices have done that in the 160 years, the U.S. Department of Agriculture has been tracking them, and Ehmke pointed out different events that influence prices—war, drought, ethanol introduction, legislation, policy, etc.—have all led to changes. There’s a pattern in the corrections, too.

“Prices spike. They don’t stay there, because nothing lasts that long,” he said. “You come right back down.”

Without looking at balance sheets, it’s pretty easy to tell we’re at the bottom now, and the next crop might see a correction or recovery.

“Now the question is, by how much?” he said. “Our research would suggest it’ll be a modest recovery, because we got a lot of commodities that need to be sold.”

What about the dollar and how it relates to grains? Weak energy prices will pull grains down, but a weak dollar will push grain prices up, he said.

“We simply have too many commodities that need to be used, and that’s pulling down prices,” Ehmke said. “It’s going to take a period of sustained low prices to clear our piles of milo, corn and soybeans.”

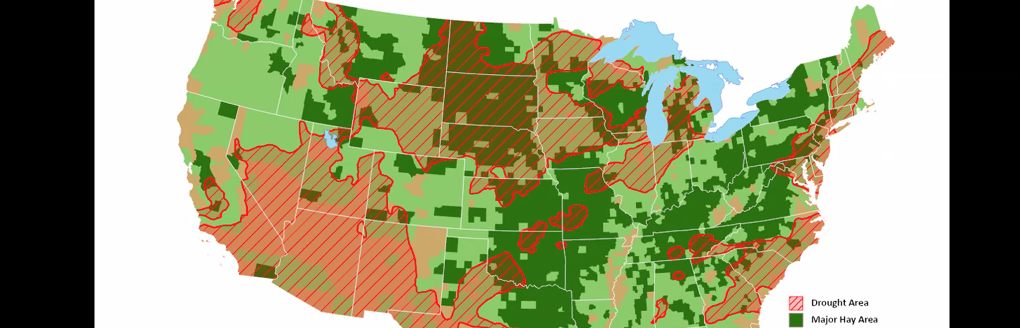

That’s not just in the U.S., but it’s also globally. Record yields were recorded in Europe, Canada and the Black Sea region. A record large soybean crop was in Brazil. Weather concerns are happening in some regions, like Argentina.

A record wheat crop was harvested in Argentina and Australia.

Ehmke takes a more cautious approach about the length of a low-price environment, especially when looking at stocks to use ratios and comparisons over a period of time.

Going forward, usage is going to catch up to supply, but it takes time. It takes a long time to get there, he said. It takes low prices to stimulate more usage and that includes biofuels in the U.S. and globally.

There are a lot of factors to consider when putting a market outlook together, and for Ehmke, broadly speaking, he anticipates a loss of acres in some commodities and continued record usage to be price positivity.

“We still have a lot of commodities in the U.S. and around the world that we are looking at from home, and so we anticipate there will be a price recovery, except that price recovery is going to be capped by the supply we have,” Ehmke said.

Kylene Scott can be reached at 620-227-1804 or [email protected].

PHOTO: Tanner Ehmke of Co Bank gave a market update Jan. 30 during the Kansas Commodity Classic. (Journal photo by Kylene Scott.)