Grain growers alert — bankruptcy by multi-state dealer means farmers need to act fast

*Disclaimer: This is not legal advice. Please contact an attorney for legal advice regarding unpaid contracts.

Hansen-Mueller Co., a larger, multi-state grain merchandiser based in Omaha, Nebraska, filed for Chapter 11 bankruptcy protection on November 17, 2025. Hansen-Mueller Co. has operations that span numerous states and serves farmers across the Upper Midwest and beyond. The ripple effects of this move are significant for suppliers, growers, and anyone waiting on payments.

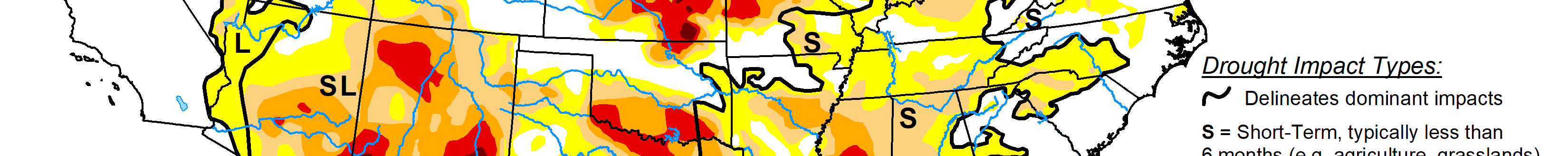

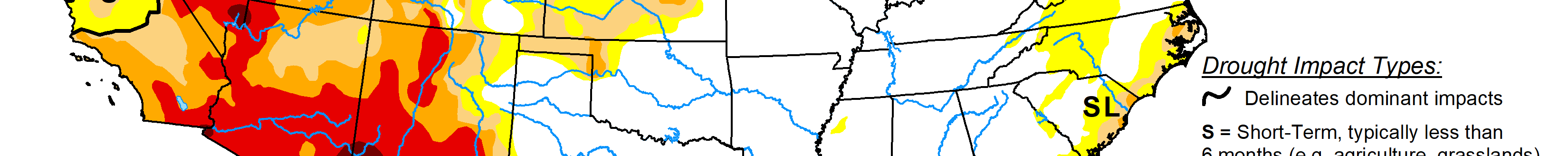

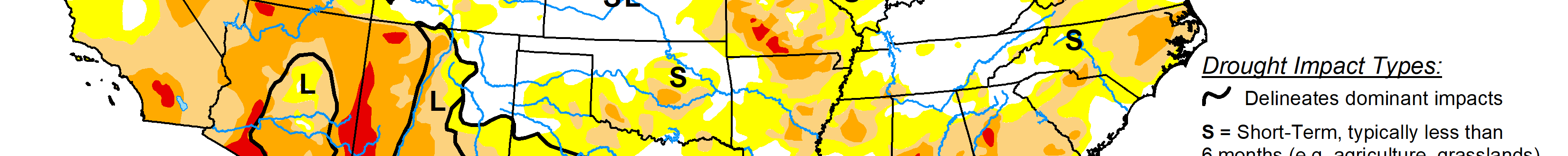

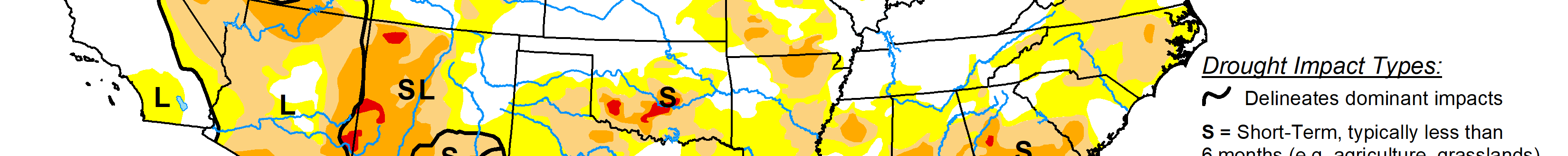

Hansen-Mueller, which operates grain elevators and port terminals, states they do business in 44 states and 24 countries, including Nebraska, Alabama, Iowa, Minnesota, Texas, Kansas, Missouri, Wisconsin, Ohio, and Louisiana, announced that it will pursue “a court-supervised sale process for substantially all of its assets” as the best strategy to address its “current financial challenges.” In Nebraska, the company’s license to operate as a grain dealer had been suspended on October 24 amid complaints that it had failed to pay several farmers.

According to court documents, the company owes creditors in 34 states. It has already reported at least 128 unpaid creditors in Kansas, 87 in Nebraska, 72 in Texas, 62 in Minnesota, and 52 in Missouri. The wide geographic spread means that farmers in many states may find themselves impacted even if they did not deal directly with Hansen-Mueller’s home office.

In Minnesota, the Minnesota Department of Agriculture issued an advisory urging producers who sold grain to Hansen-Mueller and have not been paid to submit a claim under the state’s indemnity fund. If you are farmer with outstanding contracts, scale tickets, warehouse receipts or unpaid checks tied to Hansen-Mueller, now is the time to take action and turn those in.

Farmers in Minnesota should:

- Fill out the “Grain Proof of Claim” form.

- Attach supporting materials (contracts, scale tickets, warehouse receipts, non-sufficient fund checks, etc.)

- Submit the claim by email to [email protected] or by mail to the MDA.

- Understand that valid claims may be reduced based on how long ago the contract was made.

In states other than Minnesota, farmers should check their local grain indemnity programs or state grain-dealers licensing agencies. Because Hansen-Mueller elected a court-supervision and asset-sale path, payout to unsecured creditors (including unpaid farmers) may be uncertain and could be delayed.

- Get your documentation in order now. Unpaid invoices, contracts, scale tickets: gather everything.

- Don’t assume payment will come in the normal cycle. Bankruptcy introduces risk of substantial delay or reduction.

- Check your state’s protections. Minnesota already has a fund specifically for this kind of insolvent grain buyer scenario.

- Act quickly. The earlier a claim is submitted and backed with evidence, the better your chance of recovery.

This bankruptcy of Hansen-Mueller is a sharp reminder of the sector’s exposure: even large grain merchandisers that span multiple states can collapse, and the financial pain lands squarely on farmers who trusted them. Vigilance, prompt action and perfect documentation may make the difference between recovery and loss.

PHOTO: Grain Elevators, Kansas (Photo: iStock – j12tone)