Low crop prices drive reduced farm income, FAPRI director says

Crop prices drove farm income lower, and a University of Missouri farm policy expert sees that continuing into next year.

Pat Westhoff, director of the Food and Agricultural Policy Research Institute, said lower grain prices across the board have been the catalyst. Some input costs have moderated, and cattle prices have been a major plus, he said. That will help some bottom lines.

Westhoff noted the decline in farm income between 2022 and 2025, when adjusted for inflation, is expected to be about $67 billion less. Even with the 35% decline, inflation-adjusted net farm income remains above the levels of 2015 to 2020. Net farm income peaked in 2022 at $182 billion, according to the U.S. Department of Agriculture’s Economic Research Service.

“It’s the third straight year of drop in farm income,” Westhoff said. “Since 2022, it’s a very steep decline, but if you compare it to the 2015 to 2020 period, we’re still higher than we were back then. Part of it is because of the livestock sector. The crop sector is much less favorable.”

United States net farm income was reported at about $140 billion by the ERS, and FAPRI has it pegged at $137 billion. FAPRI believes the decline will hit $129 billion in 2025, but modestly improve to $141 billion in 2026. FAPRI also pegs net farm income at $146 billion in 2027, $144 billion in 2028 and $137 billion in 2029.

In a news release from MU, FAPRI projects a $32 billion drop in crop receipts (due to lower prices for many grains, oilseeds and other field crops), while livestock receipts could see a healthy $19 billion increase with higher cattle prices in 2025. Farm production expenses were expected to modestly reduce after increasing in 2022 and 2023, but moderating in 2024.

The Federal Reserve’s recent decision to cut interest rates will lower borrowing costs, he said.

“Given the tight margins, it’s going to be even more important for farmers to make sure they are economizing where they can and doing so in ways that don’t overly affect the ability to produce and market their crops,” Westhoff said.

The latest news on farm income may influence landlords and operators as they consider rent arrangements.

“It should probably put some downward pressure around values, and we’re seeing that in some parts of the country, although we’re not seeing that everywhere just yet,” he said.

Grain markets were spurred by Russia’s invasion of Ukraine 2 ½ years ago, which came on the heels of China being a major purchaser of U.S. grain from 2018 to 2021, Westhoff said. Since then, China’s imports have leveled off.

“The question would be what is the next thing to pop up, and that’s hard to see what that might be now,” he said.

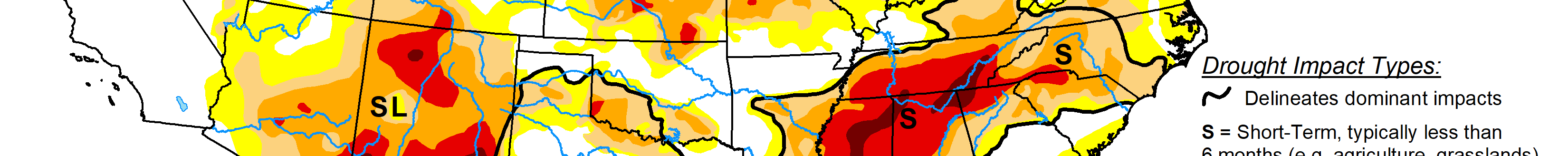

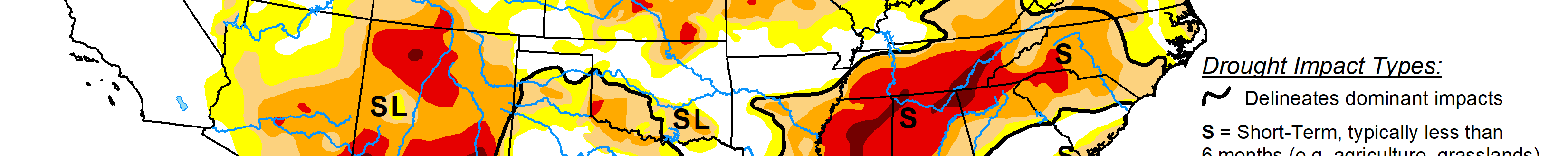

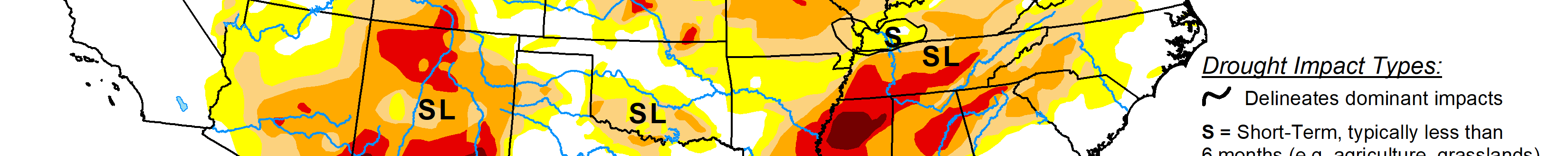

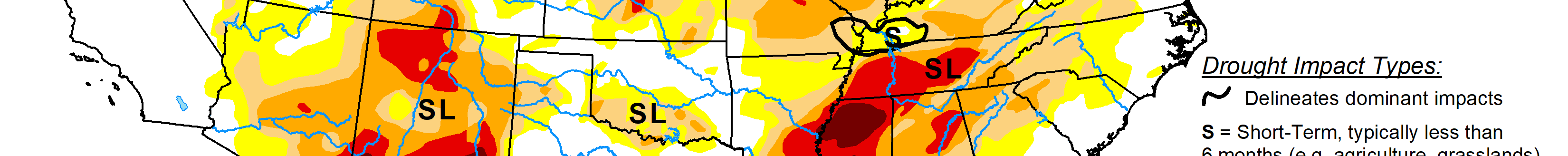

The traditional answer is weather, domestically and globally. Whether it is a short crop in South America or the U.S., Mother Nature has an important influence on markets, Westhoff said. Also, if bumper crops occur around the world, that builds up commodities in storage and drives down prices.

One hopeful sign for soybean farmers has been an opportunity to use their crop to make sustainable aviation fuel, he said, and White House policies and Congress are starting to align that could expand processing potential.

Beef production has an unprecedented run of higher prices that appear to have staying power, he said.

“It’s been a heck of a period of time for cattle producers the past couple of years, and we probably have a couple of strong years ahead,” Westhoff said, noting most experts do not see a herd expansion until later in 2025 or early 2026. Those factors have reduced supplies and increased prices at all levels of the beef chain.

If a rancher has access to forage and pasture, which has been a challenge with drought conditions in the heartland, he has an opportunity to expand his herd, the FAPRI director said.

Pork and dairy also improved in 2024, as he noted that losses in the pork industry in 2023 have stabilized. Animal agriculture has been the beneficiary of lower feed grain prices.

Government aid

For the third straight year, payments under the Price Loss Coverage and Agriculture Risk Coverage programs will fall below $1 billion in 2024. The decline in crop prices since 2022 is expected to mean payments will rise to $5 billion in 2025 and 2026.

The backdrop is putting pressure on Congress to put together a new farm bill. Westhoff said it was good news that the chairs and ranking members of the Senate and House agriculture committees are starting to talk again.

“They’re still trying to get something done in 2024, but now it is an uphill climb for a lot of reasons,” he said.

Another short-term extension is a possibility, and the negotiations for a long-term bill will take time. Lawmakers are aware of budget constraints, particularly with a farm bill, he said. The House agriculture bill that was passed in May was projected to cost $1.5 trillion over 10 years. Senate and House ag leaders disagree on how numbers will actually play out. It also comes at a time with a federal debt at $35 trillion and a presidential election in November.

Dave Bergmeier can be reached at 620-227-1822 or [email protected].