Agricultural land ownership in the United States includes individuals, corporations, estates, institutions, trusts and other arrangements such as foreign ownership. In recent years, ownership from China-based investors has received scrutiny.

Any foreign entity that invests in U.S. agricultural land must disclose doing so, according to the Agricultural Foreign Investment Disclosure Act of 1978. The act was “created to establish a nationwide system for the collection of information pertaining to foreign ownership in U.S. agricultural land. The regulations require foreign investors who acquire, transfer or hold an interest in U.S. agricultural land to report such holdings and transactions to the Secretary of Agriculture on an AFIDA Report Form FSA-153.” The Farm Service Agency is charged with compiling the data.

Foreign ownership of U.S. agricultural land expansion is well entrenched

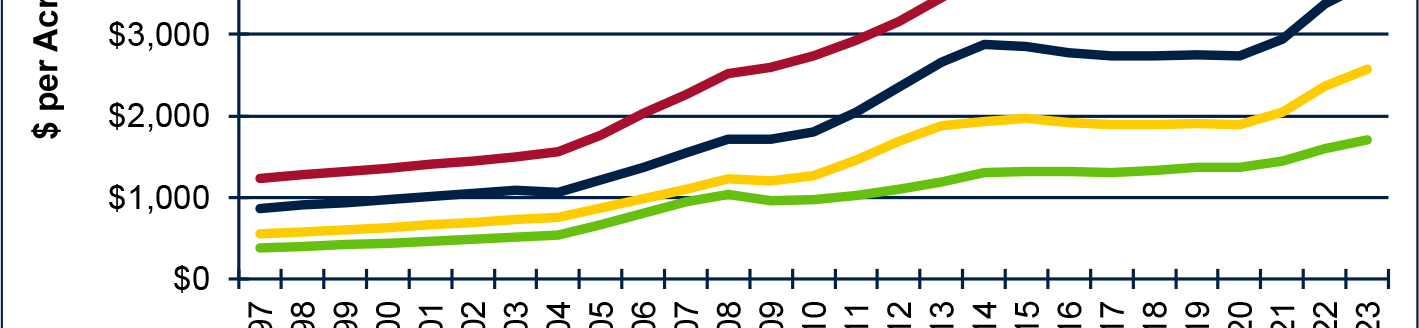

Investment in U.S. agricultural land is attractive to foreign investors. Since 2016, foreign ownership has increased by about 2 million acres annually, reaching 37.6 million acres by the end of 2021. In the High Plains, foreign ownership totaled 16.4 million acres in 2021, with an average annual growth of 12.7%.

The FSA started posting ownership data in 2016. The data includes detailed information, such as the name of the owner and the owner’s country, the type of ownership (e.g., corporation, individual, estate, etc.), year the land was acquired, the number of acres, the county where the land was bought, the purchase price, etc. Data for 2022 is expected to be posted soon.

In the High Plains, there were 3,130 foreign investors of agricultural land in 2021. They owned an average of 5,228 acres, ranging from 1.4 million acres to less than one acre. The largest owner is Invenergy Wind Development LLC from Canada. The company has been buying land since 2013, mostly in Colorado, Nebraska, Kansas, Oklahoma and Montana, presumably for wind and solar farms.

Foreign investment in U.S. agricultural land across the U.S. and the High Plains is shown in Figure 1.

Investors of U.S. agricultural land are from many countries

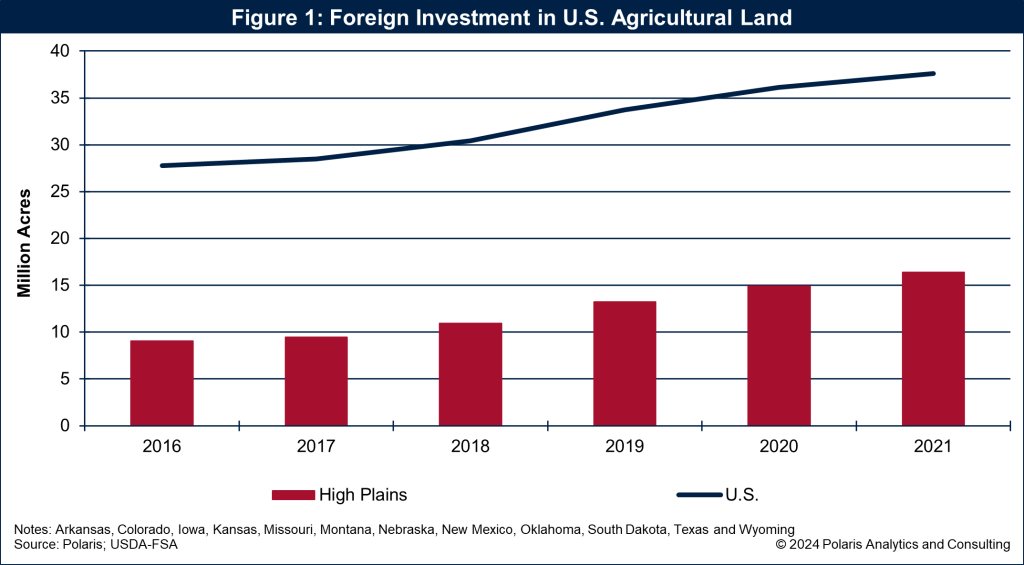

Despite the talk that China is taking over agricultural land purchases in the United States, China hardly makes a dent for land owned by foreigners. Across the U.S., investors from 10 countries account for 80% of the foreign land ownership.

Canada is the leading foreign investor, owning 34% of the foreign-held agricultural land in the U.S. Other significant investors include the Netherlands, Italy, the United Kingdom and Germany. Chinese investments account for 1% of foreign-owned land, with a significant portion in the High Plains. The top countries with foreign investment across the U.S. are shown in Figure 2.

The top five countries with the fastest growth of foreign investment in U.S. agricultural land between 2016 and 2021 were Cambodia (9,511%), Cuba (1,379%), Israel (761%), United Arab Emirates (502%) and Egypt (350%). Granted, the high growth rates were based on low starting points, but everyone starts somewhere. For perspective, investments from Chinese-based companies expanded 58% since 2016.

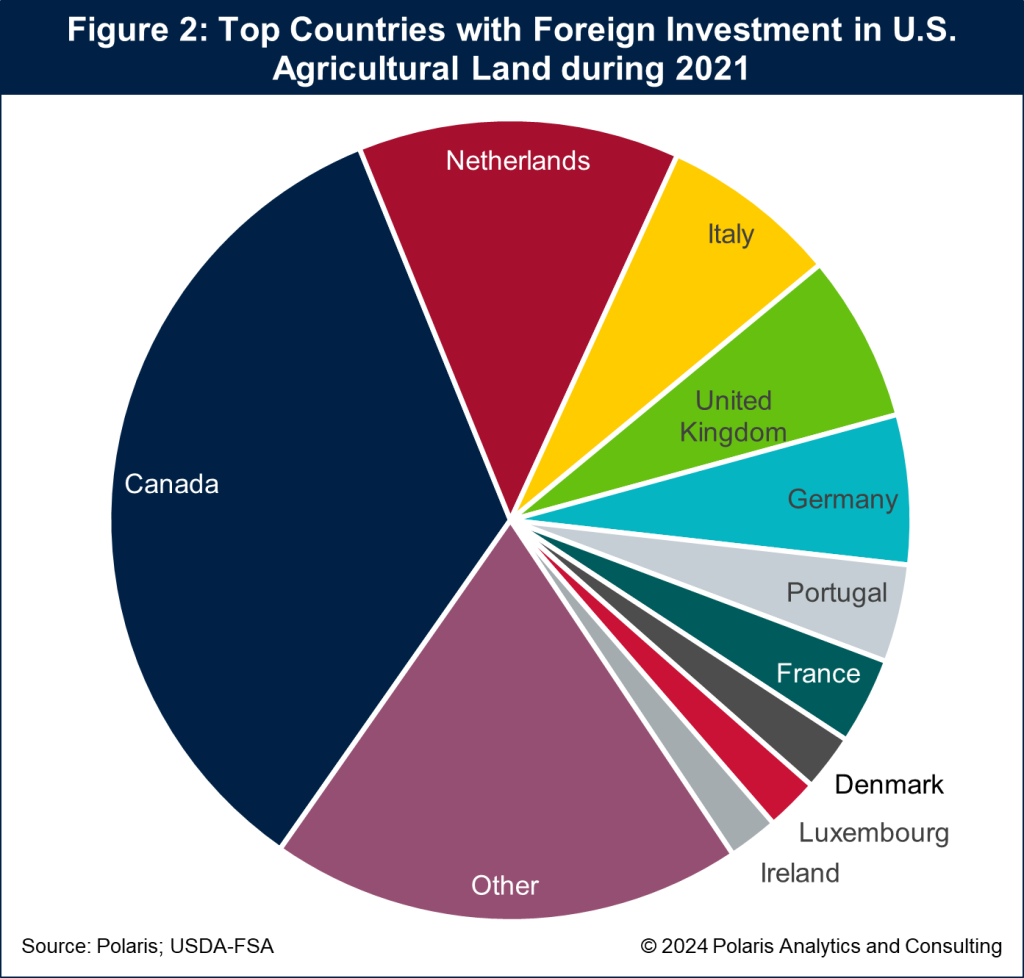

Across the High Plains, at least eight countries accounted for 80% of the agricultural land owned by foreign investors in 2021. The top five countries investing in agricultural land in the High Plains include Canada (33%), Italy (12%), the Netherlands (6.2%), Germany (6%) and the United Kingdom (5%).

The top countries with foreign investment in High Plains agricultural land during 2021 are shown in Figure 3.

China investment in High Plains agricultural land

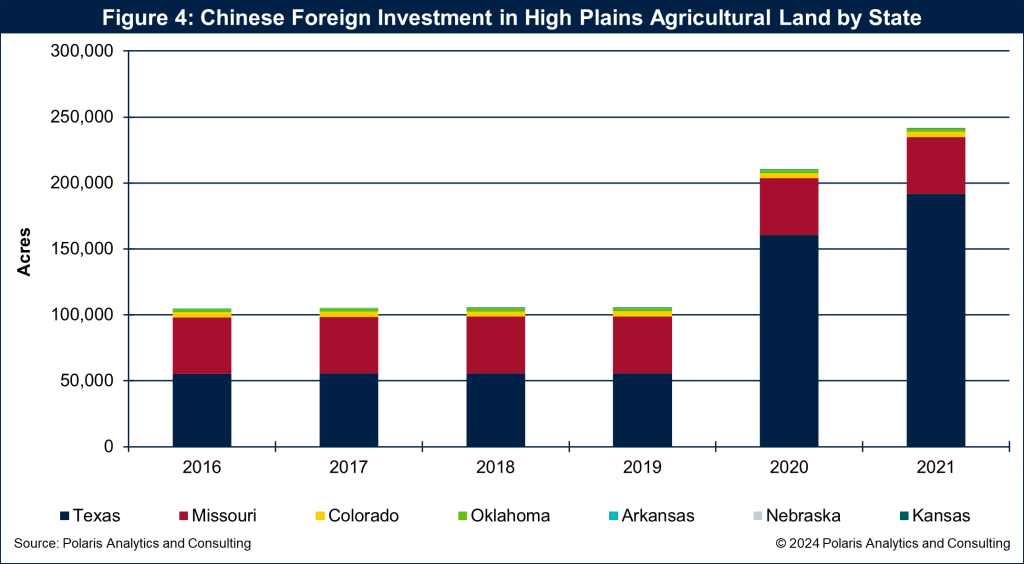

During 2021, China-based investors owned about 384,000 acres of farmland across the U.S., and 63% was in the High Plains. Of the investment in the High Plains, 80% was in Texas as shown in Figure 4.

For perspective, Chinese investors own 1.5% of the foreign-owned land in the High Plains.

The first Chinese entity buying U.S. agricultural land was in 1978. Other Chinese companies have bought land in subsequent years as well. Some Chinese companies received land through acquisitions of other U.S. companies, such as Smithfield and Syngenta.

One notable acquisition by a Chinese company happened in 2020 by Brazos Highland Properties LP. It bought more than 100,000 acres of agricultural land in Texas to build a wind farm. The acquisition led Texas politicians to pass the Lone Star Infrastructure Protection Act to prevent companies from countries such as China from buying land in Texas. While Brazos Highland Properties still owns the land, other Chinese companies wanting to invest in U.S. agriculture face backlash for doing so.

Foreign agricultural land acquisition is a buy and hold strategy

Foreign investment in U.S. agricultural land is not new, with historical acquisitions dating back to 1900. Companies invest for various reasons, including portfolio diversity, commodity hedging and resource sourcing.

The earliest acquisition reported in the FSA database was by the Choctaw Land Company from the United Kingdom. The company bought 19,000 acres of forest land in Alabama in 1900. That is a long history of buying and holding land. Many other companies have the same philosophy to buy and hold.

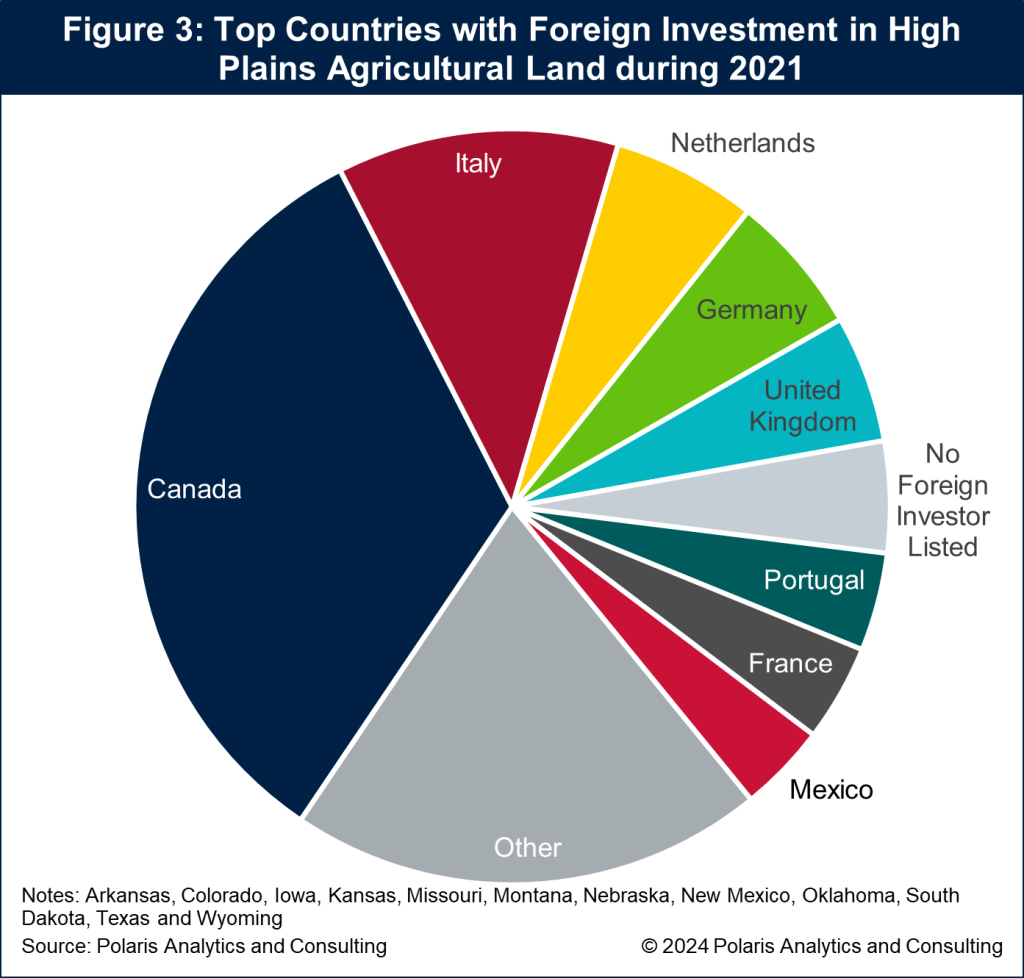

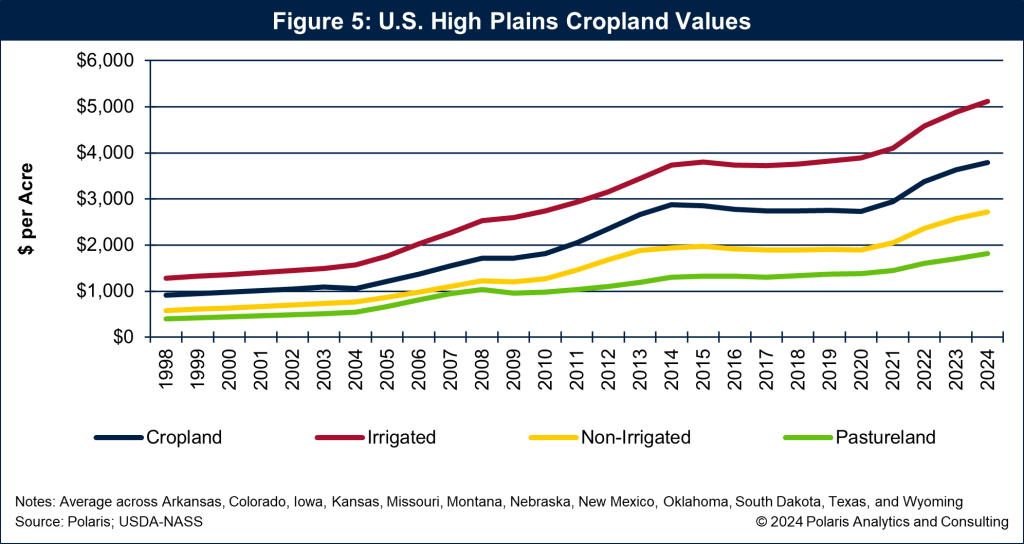

Cropland values have increased significantly over the years, making agricultural land a lucrative investment. For instance, cropland values in the High Plains have more than tripled since 1998, reaching $3,786 per acre in 2024 as shown in Figure 5.

Ownership in U.S. cropland is a promising investment, and that has not been lost on foreign companies coming to the U.S. to make those investments.

Ken Eriksen can be reached at [email protected].