Tonsor gives beef industry economic outlook at K-State Cattlemen’s Day

A Kansas State University agricultural economics professor said at the 111th annual Cattlemen’s Day March 1 that while his crystal ball may be broken, he sees a strong effort to expand the cow herd, but not until 2025.

“I think we’re going to hear a lot of chatter, depending on where you are in the industry,” Glynn Tonsor said. “General chatter is on capacity utilization, and what I mean by that is fixed assets like a feed yard, or stocker yard or packing plant that need high volume throughput to run them have fewer and fewer feeder cattle coming at them for at least the next two years.”

It probably is going to take much longer than that, and capacity utilization will continue to be a real discussion, he said.

“We have a reduced number of hooves go through the system, right? So expect a lot of that chatter within the next two years,” he said, adding the good news is that demand remains strong.

The majority of the challenges, in Tonsor’s opinion, are macroeconomic in nature but nothing unique to the beef and cattle industry.

“And why am I saying that’s good news?” he said. “If there was an image problem or a perception that the product isn’t high quality, or we thought it wasn’t safe or something that would be worse for the industry? Now, there’s something you can do about that.”

Consumers are facing inflation with increased grocery prices, and their sentiment reflects it. A pessimistic attitude has risen to the top.

“That’s weighed on meat demand broadly, not just beef,” Tonsor said. “I think that’s the main headwind for beef demand. That’s frustrating because the beef industry can’t do anything about it, but I’m trying to emphasize you have a quality product that people have shown they want when they are comfortable with the broader economic situation.”

Production

Commercial beef production is shrinking, according to Tonsor. In 2023, 4.3% fewer animals were processed than in 2022. Dress weights remained on par with the year before.

“The net of that was beef production was down 4.7% in 2023 compared to 2022,” he said. “What’s the parallel story for this coming year? In 2024, expectations are to slaughter 6.5% fewer. Dress weights are expected to go up.”

Tonsor said cheaper grain is the main driver in increasing dress weights.

“But the net of that is going to still be a notable decline of beef, specifically 5.3% less beef produced is what’s forecast for 2024 versus 2023.”

By 2025, Tonsor sees an additional 5.5% decline in cattle going through commercial slaughter channels. Five percent could be the number when it comes to beef production.

“You’re not going to find anybody who disputes the direction of those,” he said. “You can find some dispute in the magnitudes exactly where the dress weights come in. We can argue that a little bit, but the punchline I will give you today is regardless of how much I moved that dress weight, we’re going to produce less beef.”

Calf prices

Most cattle prices are “quite a bit above where they were a year ago,” Tonsor said.

“A $3 calf price historically is great, and for anybody selling the calf, I wish them the best,” he said. “But a $3 calf price doesn’t pay the bill as much as much as it did 10 years ago.”

Tonsor said it’s important to remember the overall inflation happening in this country. He’s not just talking about vehicles or cattle prices.

“The whole economy is 29% higher than it was 10 years ago,” he said. “So any rule of thumb you have in your mind about what something costs 10 years ago, much less 20 to 30 years ago, you need to multiply by 1.3 to get an equivalent kind of price.”

Sign up for HPJ Insights

Our weekly newsletter delivers the latest news straight to your inbox including breaking news, our exclusive columns and much more.

It’s just not the same $3 those beef producers are getting for their calves. Tonsor does see additional calf price increases when looking out to 2025, but they will start to moderate, particularly for fed cattle, he said.

“I think there’s a real possibility we’ll be north of $3.50, and we’ll sort of need to need to make the expansion that some want to see,” he said.

Herd expansion

Tonsor said there has been much discussion about herd expansion, with varying opinions on when and just how strong the expansion will be, but first to remember past herd counts. In 2014 the cowherd was at 28.96 million head. Most recently it peaked in 2019 with 31.7 million head.

“USDA tells us we started this calendar year with 28.2 (million),” he said. “So what I just described to you was this curve that’s on here, and that’s basically the typical cattle cycle. You know, five or six years of growing the herd obviously in terms of decline we’ve been through versions of that many times before.”

Numbers are a bit lower than they were 10 years ago, but it’s “really important” to appreciate how much more beef comes out of the cows in terms of production, he said.

“The industry is more efficient, right?” Tonsor said. “So collectively, breeding success, weaning success, all those kinds of things have improved. Slaughter weights are up, so the net result is we get more beef out of every mama cow today than we did 10 years ago.”

Ultimately there’s no need for as many mother cows as before.

“Keep that in mind in terms of how large this herd might become, given that we expand,” Tonsor said.

Heifer numbers

There are about 1.5% fewer heifers being held back in 2024 compared to 2023 and 4.9 million being held back that were on ranches Jan. 1. Nationally there haven’t been many heifers held back to expand the herd, but there is a caveat to that.

“We don’t need as many mama cows to hit the production target,” he said. “I don’t think we’re going to grow the herd as much as most people think.”

Tonsor is often asked about the expansion and the number of cows that are going to be added back, and it all goes back to the amount of meat that will come from the cow herd. He said that there really isn’t a need for or space for that many head. Before expanding, he suggests putting pencil to paper.

“I do encourage you to push the pencil, and do some homework,” he said. “We have an Excel-based tool that calculates what’s called a net present value.”

The tool will help calculate what the value is to the herd by adding a heifer as an asset to the operation.

Tonsor said to consider cash cost to run a cow and expected inflation rates to get an idea of possible future earnings. By using the U.S. Department of Agriculture’s projected calf prices of $2.95 and letting the tool do the work, a producer can see if purchasing a heifer for $1,807 works for the operation.

The tool considers how many calves a heifer might produce and how much the out-of-pocket expense might be to determine whether the cost of the heifer is worth it.

He warned that if the price of a calf changes or the rate of return increases, the tool can be in error.

“Those who are going to pay larger amounts for heifers—and I think that’s going to occur— are either more bullish on the calf market, or they’re making decisions as if their costs are low,” Tonsor said. “If they truly are, that’s a common-sense decision. If they truly aren’t, then I would discourage it because you’re locking in a lower rate of return than you might realize.”

Tonsor said the tool on www.agmanager.info is one that takes all the emotion out of herd expansion.

“The punchline of this is if we’re producing less beef, there’s going to be less beef per person available,” he said. “We need a historically high beef price to be realized. Otherwise, the demand will decline.”

As beef prices in the grocery store and eating out increase, there will be a decline in the beef needed in those places.

“But as we take 4 or 5 pounds of beef per person off the market in the next two to three years, this industry needs to see a higher beef price come out of that,” Tonsor said.

He believes that by 2025 the affordability of beef might be in question.

Final thoughts

Tonsor doesn’t believe the cowherd is expanding yet, and he anticipates that to happen in 2025.

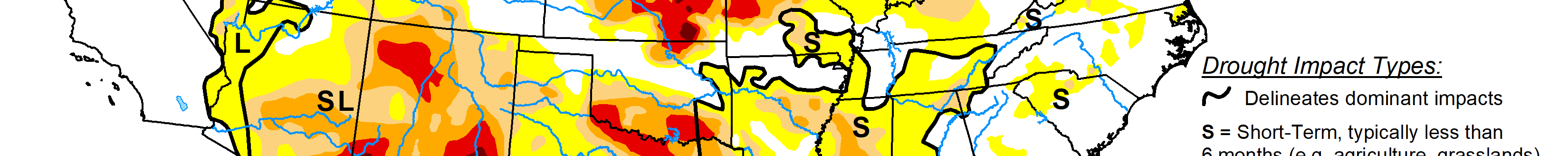

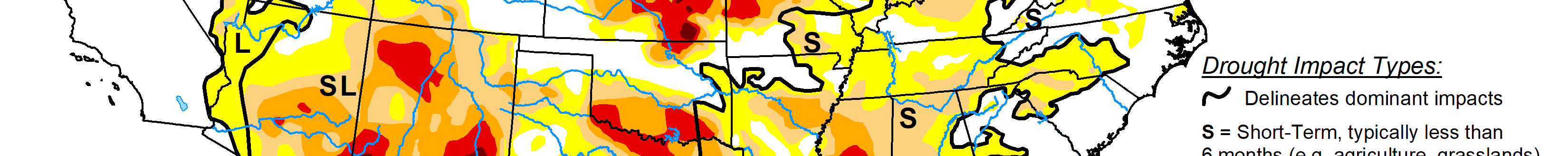

“If nothing big changes between now and then, that’s kind of a cop-out statement because we can’t go three weeks without something big going on these days,” he said. “But if Mother Nature enables it, and we don’t have massive changes in cost and so forth, I think we’ll start rebuilding herd, and we’ll see that show up in 2025.”

If that happens, a lot of heifers will come out of the system, which could be extra bullish for the calf market initially.

“I don’t think we’re going to hit 33 million beef cows,” he said. “For reference, 31.7 was the number we had in 2019. That’s sort of where my head is roughly, the ceiling to think through on the next cycle. Historically, we don’t tend to go to a new high. We tend to go a little bit lower.”

There arenot as many cows needed to produce beef because of gains in feed efficiency in the industry. He doesn’t believe there will be any more than 3 million head added to the herd. Demand is out of producers’ control because of the influence of the economy and other conditions.

Kylene Scott can be reached at 620-227-1804 or [email protected].