Dairy’s influence on beef industry noted in cowherd numbers equation

Regardless if it is beef on dairy or dairy on beef is the subject matter, a good conversation ensues as the two bovine industries look for ways to support each other.

Derrell Peel, the Charles Breedlove Professor of Agribusiness in the Department of Agricultural Economics and Extension marketing specialist at Oklahoma State University, said while the mission of beef and dairy might seem different, they both serve consumers. Peel spoke about the current cattle herd during a recent beef on dairy webinar sponsored by I-29 Moo University, which is a consortium of Extension and dairy and livestock specialists from land-grant universities from Iowa, Minnesota, Nebraska, and South Dakota.

When he gave an overview of the July feeder cattle supply numbers provided by the U.S. Department of Agriculture, he pointed out that they include both straight dairy and crossbred numbers. He also takes note of cow-calf numbers for the beef and dairy industries.

“Dairy cows have always had calves, but they don’t give much milk if they don’t have a calf,” Peel said. “We’ve always had dairy animals in the feeder mix. They look different now because a lot of them are crossbred and obviously that can affect the value and the incentives, but it doesn’t change the overall numbers all that much.”

The nation’s beef herd has always been cyclical in numbers, Peel said. In the July report it noted the herd was the smallest since 1973. The cattle report showed 94.2 million head of cattle and calves and includes 28.7 million beef cows and 9.45 million milk cows. In January the count was the lowest since 1961.

Dairy’s contribution

Dairy animals have historically been a part of the lean ground beef equation, he said. Over time there is now less Select graded beef in the market. About 15 to 20 years ago 40 to 50% of the market was Select and today it is about 80% Choice or Prime.

Meat from a dairy animal has always graded well, he said.

“Even though they’re lighter muscled, they actually graded a better percentage of Prime than beef cattle did for a long time,” Peel said. “We’ve got the crossbred animals now and as part of that continued increase (in those carcasses) there is obviously a need for some Select meat in the market.”

The beef industry has adjusted, and imports are used to supplement the supply, which traditionally had come from the culled cow and slaughtered livestock, and not from the feeder sector.

Processors use different cuts and from different sources, so it does require more imported beef now, Peel said, adding, “It’s more just from a quantity standpoint of needing more pounds of that type of meat and it’s really supplementing the cow side more than it is the fed cattle side.”

Cow-calf on front row

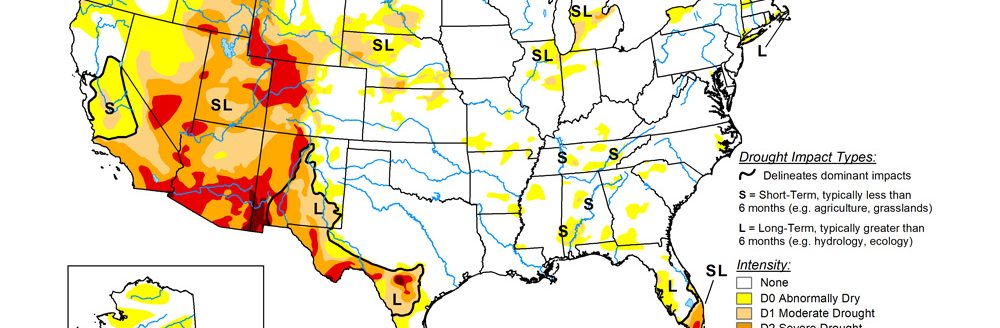

Peel said beef’s cow-calf sector for once is in the driver’s seat for profits as backgrounders and feeders have bid up prices, a reflection of a cowherd that has stalled as a result of drought and higher costs to raise the calves. Drought in many areas of the country has eased, but the pipeline for replacement heifers is limited. Even if the industry itself made a major push to retain heifers this year it will take several years for the calves to grow, be fed out and processed.

That is putting the pressure on the rest of the supply chain, Peel said. Feeders and processors have increased carcass weights to meet consumer demand although that is starting to level off.

“For everybody above the cow-calf level, the supply fundamentals are tight. They will get tighter before they get better. It looks like we’re going to continue to see high prices and tight supplies for cattle. Beef demand has been very robust so far.”

Other pressure

High prices mean elevated volatility, Peel said, adding cattle markets follow economic fundamentals, but a new wrinkle today is political volatility. Unknowns because of tariff and trade policies under the Trump administration weigh on export markets. Peel encouraged producers at all levels to have a risk management plan.

Another variable is for feedlots and backgrounders that have felt the squeeze of tight supply, but operators have benefitted from cheaper corn, he said. In looking at those sectors, feedlots might have an edge because of the volume of corn needed to finish out the animals with lower feed costs, which frees up money to bid a higher price.

In the Southern Plains, the use of wheat pasture can help backgrounders to feed livestock in the winter months, he said, and that can help them to control some of their costs.

Peel said cattle feeders are watching what happens with the New World screwworm.

The good news for the livestock sector is that American consumers continue to enjoy beef and with high retail prices it has not deterred them, he said. That could change with a macroeconomic challenge such as a sharp increase in unemployment or a decrease in consumer incomes.

“Consumer demand is based on what we’re willing to buy and what we have the ability to buy,” Peel said. “Anything that could affect that—particularly the ability to buy—is a potential threat on the demand side. I always say we’re pretty bulletproof as an industry, but we’re not bomb proof. There is always a threat out there from external factors.”

Dave Bergmeier can be reached at 620-227-1822 or [email protected].