3 updated sources of COVID-19 financial assistance for agriculture

If you’re facing economic hardship related to the pandemic, these programs can help

As financial disruptions from COVID-19 grow, federal government agencies have announced new sources of financial assistance for the agricultural industry.

These three programs can help farmers, ranchers and other ag businesses weather economic hardship stemming from the pandemic.

1. Coronavirus Food Assistance Program

Part of the Coronavirus Aid, Relief, and Economic Security Act, CFAP provides a total of $19 billion to assist farmers and ranchers, maintain the integrity of the United States food supply chain and ensure consumers have access to food.

Announced April 17 by U.S. Department of Agriculture Secretary Sonny Perdue, CFAP will channel $16 billion in direct payments to farmers and ranchers. Eligibility is based on actual losses “where prices and market supply chains have been impacted,” USDA said. The program will assist producers with additional adjustment and marketing costs resulting from COVID-19’s lost demand and short-term oversupply for the 2020 marketing year.

As of early May, the details were still being worked out, but here’s what we know.

Current CFPA allocations:

-

$5.1 billion for cattle;

-

$2.9 billion for dairy;

-

$1.9 billion for hogs;

-

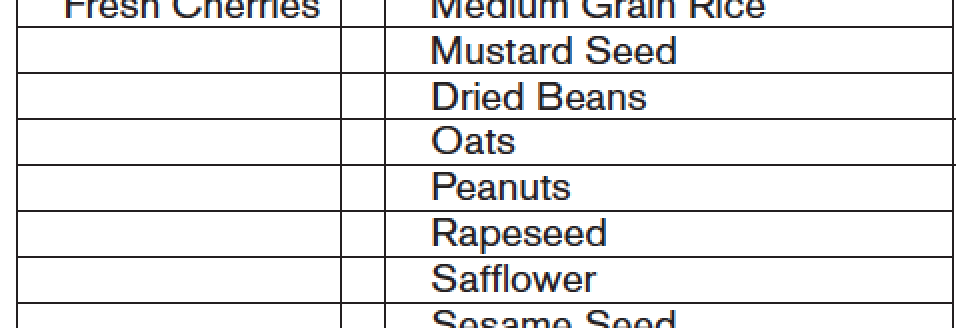

$3.9 billion for row crops;

-

$2.1 billion for specialty crops; and

-

$500 million for other crops.

Payment limit: While final guidelines haven’t been issued, we expect the payment limits to be similar to the Market Facilitation Program, with a separate payment limit of $125,000 for non-specialty crops, specialty crops and livestock.

Combined payments: If the limits are similar to the MFP, the combined payments from these three categories cannot exceed $250,000 per person or entity. General partnerships and joint ventures are not considered entities, and payment limits would look through to the members.

CFAP notables:

-

CFAP is not another Market Facilitation Program payment but a new program altogether.

-

Hemp is expected to be one of the crops that will be covered. Final guidelines, however, are still forthcoming.

-

Eligibility criteria. These might include a means test for your adjusted gross income, although Secretary Perdue hinted farmers, regardless of size, will receive help.

-

Wait for final rules. While this is changing every day, we don’t expect the mad rush we saw with Paycheck Protection Program loans. The MFP programs didn’t run out of money, and this won’t be a first-come, first-served program.

2. Main Street Lending Program

As part of the Federal Reserve’s broad effort to support the economy, the Main Street Lending program was released in April. It’s intended to help boost credit flow to small and medium-sized businesses that were in sound financial condition before the pandemic.

Since the MLS initial terms were first announced, the Federal Reserve has expanded the program’s scope and eligibility. Those updates improved the friendliness of MLS loan terms and helped confirm this as a viable option for many businesses hit hard by COVID-19’s economic consequences.

Federal Reserve Chairman Jerome Powell has stressed that the MLS program won’t run out of money. In addition, it’s important to remember that MLS is a loan program, not a grant or a forgivable loan.

Under the updated provisions, the MLS Program:

-

Is available for businesses of either 1) fewer than 15,000 employees (including those with only a single employee) or 2) less than $5 billion in 2019 annual revenue;

-

Is allowed for a borrower even if you have already filed for the Paycheck Protection Program;

-

Offers a minimum loan size of $500,000;

-

Offers a maximum loan amount of $25 million for new and priority loans but $200 million for expansion loans;

-

Defers interest and principle payments for the first year;

-

Sets length of loans at four or six years, depending on the specific loan program chosen;

-

Sets the interest rate of loans at LIBOR plus 3%; and

-

Establishes several other restrictions and guidelines.

3. Economic Injury Disaster Loan

Agricultural businesses can now apply for Economic Injury Disaster Loan and EIDL Advance programs, the Small Business Administration announced May 4.

SBA said additional funding authorized by Congress in late April finally allowed ag businesses to access this emergency working capital. Until the recent legislation, SBA had been prohibited by law from providing disaster assistance to ag businesses for more than 30 years.

SBA is accepting new EIDL applications on a limited basis only, so it can focus on providing unprecedented relief to U.S. agricultural businesses. For agricultural businesses that submitted an EIDL loan application through the streamlined application portal before the legislative change, SBA will move forward and process these applications without the need for re-applying. All other EIDL loan applications that were submitted before the portal stopped accepting new applications on April 15 will be processed on a first-in, first-out basis.

Applicants have the option to receive $1,000 per employee with a maximum grant of $10,000 as well as getting low-interest, long-term loans if needed.

Reach out for help

As I noted last month, K·Coe Isom has considerable information about CARES and other programs. We’re supplying new information every day on our website, including recordings of our town hall meetings. Visit www.kcoe.com/covid19 for COVID-19 resources and updates.

Editor’s note: Maxson Irsik, a certified public accountant, advises owners of professionally managed agribusinesses and family-owned ranches on ways to achieve their goals. Whether an owner’s goal is to expand and grow the business, discover and leverage core competencies, or protect the current owners’ legacy through careful structuring and estate planning, Max applies his experience working on and running his own family’s farm to find innovative ways to make it a reality. Contact him at [email protected].