Ag’s balance sheets remain strong, economist says

Although interest rate increases have created a headwind, farmers and ranchers continue to have good balance sheets.

“We’ve seen some tightening profit margins in the farm sector but it really hasn’t translated into a lot of financial pressure in large part because the past couple of years have been as strong as they have been,” said Nathan Kauffman, senior vice president, economist and Omaha branch executive, in a telephone interview on Dec. 1. Kauffman is the Kansas City Fed’s lead officer and regional economist in Nebraska and the bank’s principal expert on the agricultural economy.

The third quarter findings of the KC Fed shows that while lending activity has slowed, delinquency rates on agricultural loans dropped for the third consecutive year and remained at a historically low level. The KC Fed’s analysis was issued Nov. 30. Higher interest rates have induced greater competition for deposits, pushed up costs of funding and compressed net interest margins slightly in recent months, according to the analysis by Kauffman and Ty Kreitman. They noted profits for agricultural banks have stayed solid with support from higher interest income.

Tighter margins expected

Kauffman expects tighter margins in 2024 as a result of a decline in crop prices and some segments of the livestock industry are also pressured, particularly in pork and dairy.

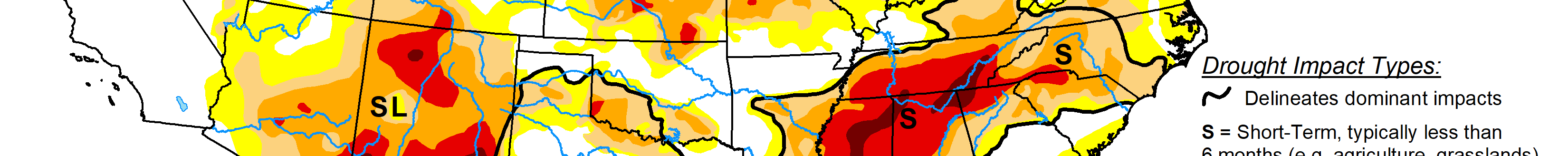

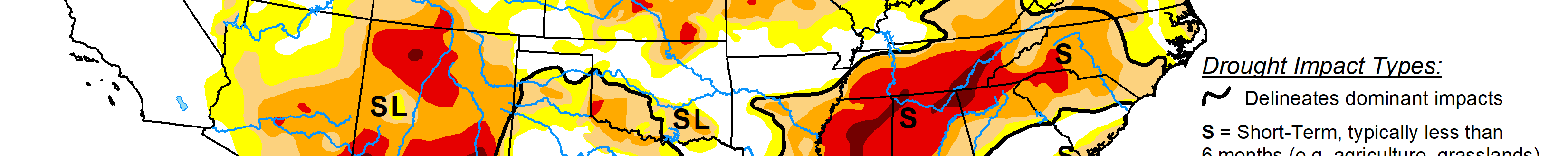

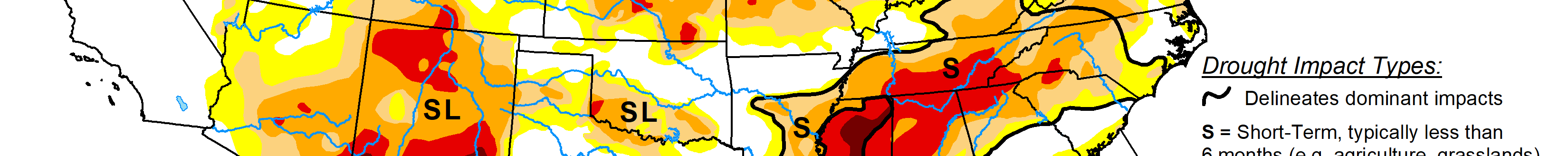

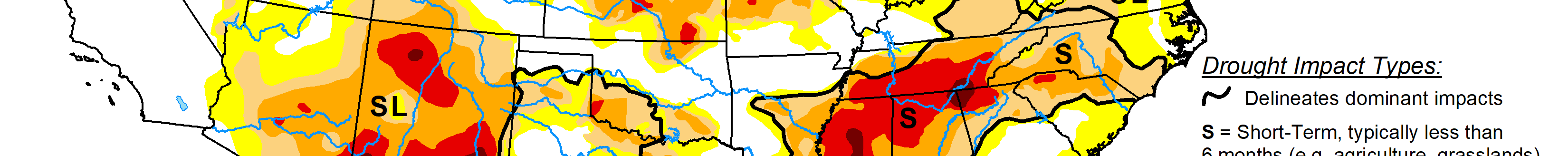

“Drought has been a factor and we know higher interest rates have also weighed on borrowers.”

While it is tighter, he said the farm sector in his district is coming off a period where the economy had been exceptionally strong.

Several years ago interest rates were about 3% on an operating loan but are significantly higher today and that caught the eye of Kauffman.

Kauffman said the increase of interest rates on operating loans is impacting farmers and lenders but they seem to be on the same page as banks are wary of increased risk and borrowers are more cautious. Interest expense can be a substantial expenditure, and with the rate nearly three times higher that has slowed operations that are looking to expand but need to borrow to accomplish it.

Kauffman does not see the scenario that happened in the mid- to late-1970s when land values kept increasing during a period of high inflation leading to rapid expansion but as cash flow tightened and interest rates soared in the early 1980s it led to the farm crisis.

“Even though interest rates have increased significantly from where they were a couple of years ago they’re still relatively moderate in comparison to those times,” Kauffman said. “Lenders have generally taken a more cautious approach to how they go about extending credit.”

Also crop insurance has been an important risk tool that was not available 40 years ago, he said.

Livestock

The hog industry has faced significant financial pressure in 2023 and that’s coming about because of higher feed costs while market prices have been subdued. The dairy industry has faced similar financial pressure.

Crop prices have been lower and that will help lower feed costs but tighter margins are also a part of the financial equation for both sectors, he said.

The drought has been the dominant story for the cattle industry, he said. In the High Plains it has slowed the expansion of the nation’s cowherd, and some producers are still liquidating because of feed costs and other challenges.

“For those producers that have managed to get by and have cattle available to sell the prices are obviously extremely attractive given the levels we’re at,” the economist said.

However, producers who have had to liquidate because of the drought face a different scenario.

“We’re definitely watching that industry given some of the cost pressures and also the prices that have risen quite dramatically the past couple of years,” he said.

Feed costs have come down but the drought is still a factor in certain regions and lack of water availability is playing a part.

Sign up for HPJ Insights

Our weekly newsletter delivers the latest news straight to your inbox including breaking news, our exclusive columns and much more.

Next 12 to 18 months

Kauffman said both producers and bankers will need to be “very careful in managing cash in an environment where interest rates have increased to the extent that they have while having the working capital available to respond to any potentially unforeseen shocks.”

His advice is for farmers and rancher to continue to focus on marketing strategies with a disciplined approach. They should avoid the temptation of trying to capture the highs of the market.The U.S. Department of Agriculture recently noted that while net farm income is down 15%from 2022, 2023 remained a good year. Kauffman said with several years of strong net farm income, tightening is expected and the good news is that has not lent itself to considerable financial stress.

As Congress looks to put together a five-year farm bill, Kauffman said his hope is lawmakers will add greater flexibility.

“It’s sometimes difficult to anticipate what things might look like in a five-year horizon,” he said. “When we look back at the past five years it would be hard to know what would play out quite as they have the past few years. I would suggest taking a fairly moderate approach of recognizing where there could be pressure even if right now it seems like things are still pretty financially strong.”

Kauffman said the Fed gets many questions about real estate values in light of higher interest rates. There are areas where the values have come down while others continued to increase. The rate of increase has slowed but the KC Fed is still seeing farmland values increase 3 to 7%.

“That’s been strong and for those that have it they can use it to draw off as potential equity or collateral for other loans,” he said.

Dave Bergmeier can be reached at 620-227-1822 or [email protected].