Pork industry has positive eye toward 2026

Pork farmers have been weathering the impact of tariffs and production costs as they look ahead to a new year.

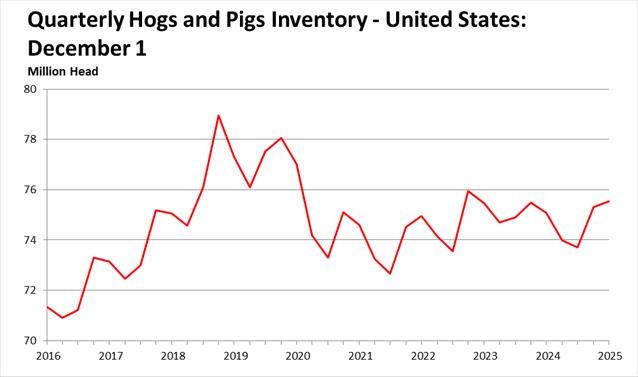

As of Dec.1, there were 75.5 million hogs and pigs on United States farms, up 1% from December 2024 and up slightly from Sept. 1, 2025, according to the Quarterly Hogs and Pigs report published Dec. 23 by the U.S. Department of Agriculture’s National Agricultural Statistics Service.

Holly Cook, an economist with the National Pork Producers Council, said before the report a survey of analysist estimates showed an average expectation that all hogs and pigs would be nearly 1% below year ago levels. The actual survey result showed all hogs and pigs were up 0.6% from Dec. 1, 2024, indicating a 1.5% difference between the average analyst expectation and the actual result.

“Generally, more than a 1% difference between expected and actual reported values is considered a surprise,” Cook said.

A look at estimates

All USDA estimates, except for the 180 pounds and over market hog inventory, were below the average of pre-report expectations, said Lee Schulz, chief economist at Ever.Ag. Furthermore, eight USDA estimates were below the lower bound range of pre-report expectations.

Like Cook, he said the plus or minus one percentage point from the average of pre-report expectations is considered surprise.

“For each report there can be a couple of USDA estimates that are a surprise under this criterion,” Schulz said. “In this report, there were four USDA estimates that were three percentage points or more below the average of pre-report expectations. If a one percentage point difference is a surprise, then a three-percentage point difference is a shocker.”

When compared to year ago levels, there are currently stable but possibly tightening numbers, he said.

The inventory of hogs weighing 180 pounds and over on Sept. 1, 2025, was up 0.3% compared to Sept. 1, 2024. Hogs weighing 180 pounds and over on Sept. 1 come to market in September through mid-October. On average, pre-report analysts expected the heaviest weight group inventory down 0.6% compared to 2024. September slaughter to-date is down 0.2% compared to a year ago.

Hog slaughter will have to run about 1% above a year ago for the next three weeks to match where USDA has the 180 pounds and over market hog inventory, Schulz said on Dec. 23. The inventory of hogs weighing 120 to 179 pounds on Sept. 1, 2025, was up 0.4% compared to Sept. 1, 2024. These hogs would be expected to be slaughtered mid-October through mid-November. On average, analysts expected this inventory to be up 0.5% compared to 2024.

Into the marketplace

The June through August 2025 pig crop at 34.078 million head was down 2.6% compared to the same period a year prior and is 2.292 million head lower than the record pig crop for thequarter recorded in 2019, Schulz said. These pigs will come to market January through March 2026.

U.S. hog producers intend to have 2.855 million sows farrow during the September through November 2025 quarter, which would be down 2.4% from the actual sows farrowing during the same period one year earlier and the smallest for the quarter since 2013, Schulz said. This is the second sows farrowing intention estimate for the September through November 2025 quarter and producers dropped 91,000 sows from the intentions estimate from three months ago in the previous Quarterly Hogs and Pigs report, he added. September through November 2025 sows farrowing will drive two quarters ahead slaughter for April through June 2026 slaughter.

Weaned hogs were down 3% from the previous period.

“The lightest two market hog inventories came in markedly lower than analysts’ pre-report expectations and lower than a year ago,” Schulz said.

Hogs weighing 50 to 119 pounds were down 2.3% compared to a year ago, he said. These hogs are expected to come to market mid-November through December 2025. On average, analysts had this category up 0.8%. Pigs under 50 pounds will come to market January through February 2026 and were down 2.4% compared to last year. This was much lower than analysts’ expectations of up 0.7%.

Breeding hog numbers

Schulz is also watching the breeding hog inventory numbers.

The U.S. breeding inventory, at 5.934 million head, was down 1.8% from last year, and down 0.3% from the previous quarter, he said. This was the smallest Sept. 1 breeding herd since 2014.

“Coming into the report, there was some thought that producers may have expanded the breeding herd in the last three months,” Schulz said. “Yes, sow slaughter over the last 15 weeks has been down 5.9% or 51,754 head compared to the same period in 2024. However, at a somewhat static replacement rate one would expect lower sow slaughter because there are fewer sows to cull from,”

Also, sow and boar imports for slaughter from Canada are down 4.2% or 3,772 head over the last 15 weeks, Schulz added. Furthermore, USDA revised the June 1, 2025, breeding herd down by 0.5% or 30,000 head.

“As you think about the breeding herd, one could argue we have the most productive breeding herd ever,” Schulz said. “This is evidenced by continued increases in litter rates.”

The average pigs saved per litter in the U.S. was 11.82 for the June through August 2025 period, compared to 11.72 last year, he said. The June through August litter rate has now broken a record in 2023, 2024 and 2025.

Production

USDA World Agricultural Supply and Demand Estimates report in December projected production at 27,475 million pounds for 2026.

Cook said USDA’s weekly reports indicate pork production has been down about 0.4% in 2025 vs. 2024. The most recent USDA WASDE forecasts show production in 2026 expected to be very similar to 2025, with production levels falling year-over-year lower in Q1 and Q2 before increasing in Q3.

“USDA will likely adjust these forecasts with the results of the latest Hogs and Pigs Report, but the inventory in market weight categories that would account for early 2026 production are similar to 2025,” Cook said.

Exports

The picture for exports after a tougher 2025 are showing signs of improvement as USDA projects pork exports at 7,020 million pounds for 2026, which was similar to 2024 levels.

The U.S. became the top exporter of pork in the world in 2024, Cook said. Through August, carcass weight export data indicates exports down 2.5%, and USDA expects slight improvement from 2025 to 2026.

U.S. pork exports continued to build momentum in October, led by a record performance in leading market Mexico, according to data released by USDA and compiled by the U.S. Meat Export Federation.

Pork exports totaled 264,657 metric tons in October, up 5% from a year ago, valued at $762.1 million (up 7%), the USMEF noted. Both volume and value were the largest since March, led by substantial growth in Mexico and year-over-year increases to Central America, Canada, Japan, South Korea and the Philippines. In addition to Mexico, October shipments were also record-large to Honduras and Guatemala.

“In July 2025, the U.S. hammered out a trade deal with the Philippines, giving a host of U.S. products duty-free access,” Cook said. “Products from the Philippines will now have a 19% tariff. NPPC supports the Philippines agreement, which is an important market for U.S. pork, and will review the details as they become available.”

Opportunities

Cook said while margins have tightened in Q4 and into early 2026, USDA reports and futures market prices imply continued profit opportunities for pork producers in 2026.

Schulz said producers should consider all tools and strategies available to accomplish price risk management objectives.

“Do not wait for the market to come to you,” he said. “Remember, the point of maximum financial risk is at the market peak, when prices (or profits) are highest. Establish price floors. Insure prices or margins. Set several target prices to allow for changing market trends.”

Producers have been on defense for much of the last couple of years due to adverse conditions in late-2022 through early-2024, he said. They should be thinking about how and when they can go on offense to take advantage of current and future market opportunities.

Much has been discussed, especially in the last couple of years, about strategies when times are tough, Schulz said. In reality, the most important decisions are often made when times aren’t so tough.

If one of the goals of the business is to produce profits for personal use, then profit taking is in line with operational goals, he said. If the overriding goal is to grow the business, then consider strategies to acquire productive assets.

“If the ultimate vision is long-term profitability, then plan ahead for future times when generating profits might be more challenging,” Schulz said.

While pork producers are watching the record high beef prices, he encouraged them to focus on their own risk management strategies.

Dave Bergmeier can be reached at 620-227-1822 or [email protected].